Open a Virgin Money Go transaction account bundled with a Boost Saver account and you’ll earn 5,000 bonus Virgin Money points after you make your first debit card purchase, direct debit or BPAY payment in the first 30 days.

Virgin Money points can now be transferred to Velocity Frequent Flyer at a rate of 2:1, allowing you to instantly convert your 5,000 Virgin Money points into 2,500 Velocity points.

Alternatively, you can redeem the 5,000 points for $22.50 in cash or convert them to other points programmes including Marriott Bonvoy (2:1), ALL Accor (3:1), Qatar Avios (3:1), United MileagePlus (3:1) and Etihad Guest (5:1).

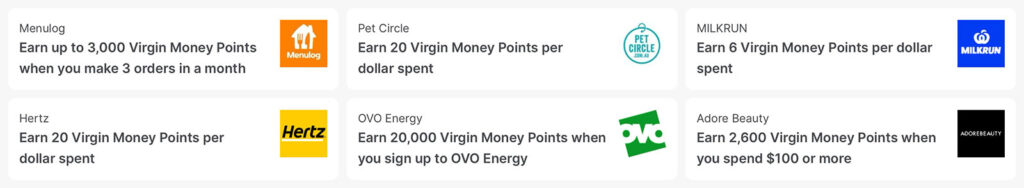

The Virgin Money Go account allows you to earn 8 Virgin Money points on every transaction (not per dollar, per transaction) and you can also receive bonus points when spending with selected partners.

Whilst only new customers can receive the 5,000 points joining bonus, existing customers can earn 5,000 points for themselves every time someone signs up using their code and meets the welcome offer criteria (maximum of 5 referrals per month).

What are 2,500 Velocity points worth?

It depends on how you redeem them:

Terms and conditions

The Virgin Money Go Account comes bundled with the Virgin Money Boost Saver. New Virgin Money Go Account customers will receive 5,000 Bonus Virgin Money Points when they make one (1) debit card purchase, direct debit or BPAY payment from their Virgin Money Go Account in the first 30 days from account opening. Debit card purchases must settle in the first 30 days from account opening (not pending). Cash withdrawals, deposits, refunds, reversals or credits to the Virgin Money Go Account, Pay Someone payments and internal transfers are excluded. For customers who open a Virgin Money Go Account jointly with another person, the Bonus Points will be split and evenly allocated to both joint account holders of that account once the Welcome Offer Criteria have been met. Virgin Money reserves the right to amend or withdraw this offer at any time without notice. A new customer is any person who does not currently or has not previously held a Virgin Money Go Account or Virgin Money Grow Saver. Offer ends 31 January 2026. For further information on the Virgin Money Rewards Program refer to our terms and conditions.

See here for the complete terms and conditions.

17 Responses

So a $1 transaction earning same number of points as $100!

Didn’t realise bit this is a decent way to earn Bonvoy points!

Thanks for this! Is there a way to retrospectively add a referral code? There wasn’t a field on the application but after visiting your site for more info – realised I should’ve used your link instead!!

Thank you for the offer but I don’t believe you can add them retroactively. In any case, I’m quite sure I’ve used up my five referrals for this month.

I can’t find the referral code

I had to remove it as Virgin Money banned me for “not complying with the Refer a Friend Offer Terms and Conditions” but don’t worry, there’s no extra benefit to you if you sign up with a referral code (only the referrer) so you can just sign up normally and you’ll still be eligible for the 5,000 points welcome offer.

How long did it take for your points to be credited folks? My first transaction had been pending for a few days but has come good now – but no points (not even base points).

They say the points can take up to five business days to arrive so I’d give it a week before messaging them in the app.

How long till the bonus points hit the account? I have made the spend criteria and it has all gone through.

If you don’t receive them after five business days then you can send them a message from within the app.

If I buy something for $100 and do 100 split payments/transactions at $1 each (say at a supermarket where it is easy to do) would I get 8 x 100 Virgin points?

Their terms specifically state that you cannot game the system by deliberately making many small transactions so I wouldn’t recommend it.

Clicked through everything properly but they only opened a Virgin Money Go transaction account without the Boost Saver bundled. I don’t plan on actually using this apart from that 1 transaction. Is it worth opening the Boost Saver manually to ensure that the points are tracked?

You could message them just to be extra sure but reading the terms and conditions it sounds like you’d still qualify.

Sam, did you get the points without the boost saver bundled?

I created a VM Go account when I first saw this – thanks very much for flagging!

I have received and started using the debit but have not seen the 5000 bonus points yet -any idea how long do they take to credit them? Is it worth messaging them?

I don’t believe they specify a timeframe for the points to be credited so definitely message them and see what they say.